Yellen: "I Don't Believe We Will See Another Crisis In Our Lifetime"

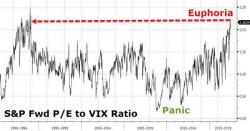

If there was any confusion why the Fed intends to keep hiking rates, even in the face of negative economic data, it was all put to rest today when not one, not two but three Fed speakers, including the two most important ones, made it very clear that the Fed's only intention at this point is to burst the asset bubble.