Global Stocks Roar Back To All-Time Highs As Irma, North Korea Fears Fade

And we're back at all time highs.

And we're back at all time highs.

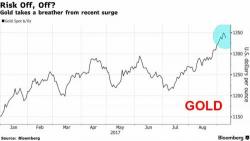

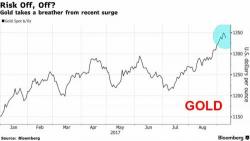

European stocks dropped, Asian and EM market rose, and S&P were lower by 0.3% as investors assessed the latest overnight carnage in the USD which plunged to the lowest level since the start of 2015, sending the USDJPY tumbling to 107, the euro extending gains to just shy of $1.21 and a slowdown in China’s export growth which however did not prevent the Yuan from posting its best weekly gain on record.

By Chris at www.CapitalistExploits.at

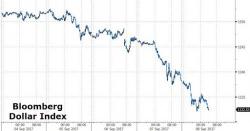

When I set out over a year ago to just once a week highlight one element of absurdity (because it is absurdity which often leads to asymmetry and thus profits) on this ball of dirt we call home, it was inevitable that I wouldn't have much trouble in finding things to jeer and laugh at.

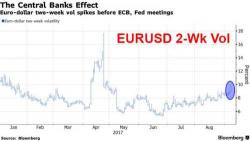

S&P futures are flat, still spooked by the WSJ's report that Gary Cohn will not be the next Fed chair, while both European stocks and Asian shares gain in a overnight session on edge in which everyone is looking forward to today's main risk event: the ECB meeting and Draghi press conference due in under two hours. The dollar continued to weaken against most G-10 peers as tensions over North Korea, concerns over Stan Fischer's resignation and the increasingly cloudy Fed outlook outweighed positive sentiment from the US debt ceiling extension.

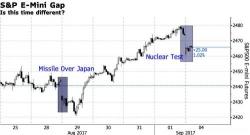

Yesterday morning, with the US closed for holiday but with S&P futures trading modestly lower on the latest set of North Korean geopolitical fears, we asked "is this time different", referencing last week's similar setup, when futures gapped lower on Monday after the Kim regime shot a missile over Japan, only to surge into the end of the week.