Bond Rout Fades With Futures Flat Ahead Of Payrolls; Pound, Yen, Oil Tumble

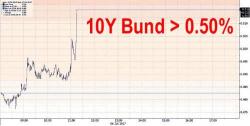

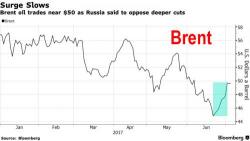

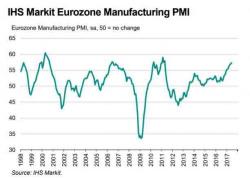

S&P futures are little changed following yesterday's rout even as Asian and European markets continued selling; the pound slid on poor factory data, the yen tumbled after the BOJ intervened to stabilize the JGB bond market, precious metals flash crashed early in the session, while the selloff in oil accelerated despite yesterday's massive inventory draw, although at least yesterday's sharp bond tantrum has stabilized.