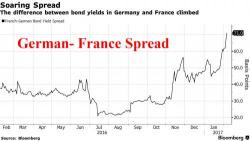

Global Stocks Rise, S&P Futures Make New Record Highs As "Trump Trade" Euphoria Returns

European and Asian stocks, S&P futures, bond yields, the dollar and commodity metals are rose, in some cases making new all time highs, lifted by the latest reemergence of the "Trump trades" as hopeful investors once again bet that the U.S. president's tax reform plans will boost economic growth and corporate profits, despite another warning from Goldman that the president's fiscal plan is about to be derailed.