"We Are Disappointed" - Goldman Removes Apple From "Conviction Buy" List, Cuts Price Target From $155 To $136

The tide has finally turned on what until recently was every sellside analyst's favorite stock.

The tide has finally turned on what until recently was every sellside analyst's favorite stock.

For those who thought that the world's biggest company losing over $40 billion in market cap in an instant on disappointing Apple earnings, would have been sufficient to put a dent in US equity futures, we have some disappointing news: with just over 7 hours until the FOMC reveals its April statement, futures are practically unchanged, even though the Nasdaq appears set for an early bruising in the aftermath of what is becoming a disturbing quarter for tech companies. "It’s pretty disappointing,” Angus Nicholson, an analyst at IG Ltd., told Bloomberg.

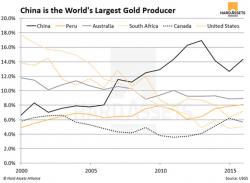

Via HardAssetsAlliance.com,

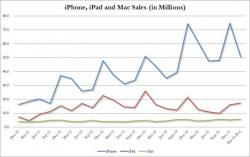

Apple spent about five years developing the iPhone, which has changed the smartphone market forever. Until the release, however, nobody could imagine what impact the iPhone would have on the market.

And most consumers didn’t know about it at all.

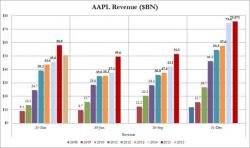

First it was Twitter, now it is consumer tech titan AAPL's turn to tumble. For those pressed for time, here is the breakdown:

Shortly after the close today, Apple will report its much watched earnings which will be closely watched for several reasons. The biggest one is that since Q1 2014 AAPL has contributed 25% of the S&P’s 4.2% growth rate (excluding the EPS benefit of the company's massive buyback program). Furthermore, roughly 40% of the nearly 9% jump in Tech margins since 2009 is attributable to Apple alone.

However, that was all in the past: this quarter Apple is actually forecast to subtract 0.7% from the S&P's bottom line.