US Futures, Europe Stocks Jump On Oil, USDJPY Surge; Ignore Poor China Data, Iron Ore Plunge

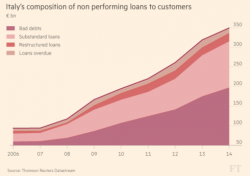

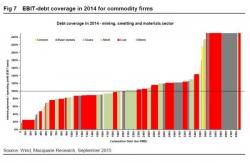

The overnight session has been one of alternative weakness and strength: it started in China where stocks tumbled 2.8% to a two month low following an unexpected warning in the official People's Daily mouthpiece that debt and NPLs are too high, not to expect more easing will come, and that the Chinese Economy’s performance won’t be U- or V-shaped but L-shaped.