Global Stocks Roar Back To All-Time Highs As Irma, North Korea Fears Fade

And we're back at all time highs.

And we're back at all time highs.

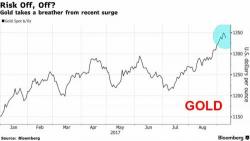

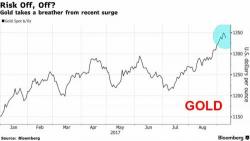

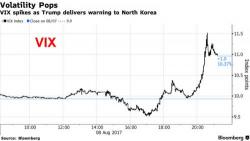

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday's sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks.

The levitation continues with S&P futures pointing to - what else - another higher open while European stocks swung between gains and losses on the busiest earnings days of the year (85 of the Stoxx 600 report) which has seen European pharma giant AstraZeneca plunge 15%, the most on record, after its flagship lung cancer trial Mystic failed to show benefits, while Deutsche Bank slumped 4% on a 12% plunge in FICC revenue.

The relentless risk levitation continued overnight, as global shares extended their stretch of consecutive record highs on Thursday for a 10th day after a cautious BOJ lifted Asian stocks to a decade high with a dovish announcement that offered no surprises, while pushing back Kuroda's 2% inflation target to 2020, the 6th consecutive delay. With all eyes on the ECB in just over an hour, US equity futures are in the green, following solid gains around the globe. European stocks extended their biggest gain in a week while Asian equities maintained their rally.

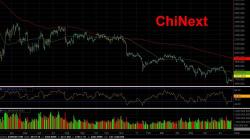

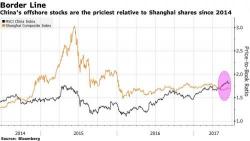

After three consecutive unsuccessful attempts by China to have its A Shares included in the MSCI Emerging Market index, moments ago the fourth time proved to be the charm, when MSCI finally relented and agreed to add China's A shares to the much desired index.