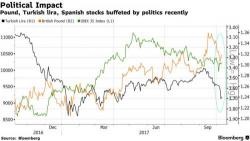

European Stocks On Edge Ahead Of Catalan Independence Call, S&P Futures Rise

S&P futures are again modestly in the green as European shares hold steady ahead of a meeting of the Catalan regional parliament and a possible declaration of independence by Catalan leader Puigdemont, while Asian shares rise a the second day. The dollar declined for the 3rd day, its losses accelerating across the board amid growing concerns that Trump's tax reform is once again dead following the Corker spat and a rejection from Paul Ryan, with the move gaining traction after China set the yuan’s fixing stronger for the first time in seven days.