Nasdaq Nears 2-Month Lows As FANG Stocks Gives Up Yesterday's Dead-Cat-Bounce

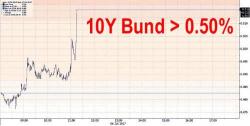

10Y Treasury yields are hovering back at 2-month highs, but that 'selling' is not rotating into stocks as high-beta 'no brainers' are slumping once again. FANG stocks have erased yesterday's gains and Nasdaq 100 is now back at its lowest since April...

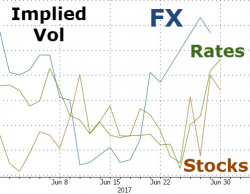

As both bonds and stocks are sold...