Hedge Fund CIO: "$100BN Of Tech Stocks Got Sold And The S&P Was Unchanged. Not Sure How That Happens"

The start of another week is upon us, which means it is time for choice excerpts from the latest letter to clients by One River Asset Management CIO Eric Peters, who today writes about Brexit, the "new generals" in the market (more in a later post), rising populism in a world of tech "monopolies", modern day robber barons, and much more.

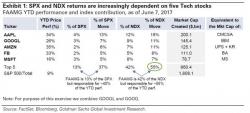

We will have more from today's letter shortly, but for now here is Peters on a topic on everyone's minds, volatility, and what Friday's Nasdaq "air pocket" means:

Beep Beep