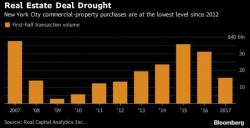

NYC Commercial Real Estate Sales Plunge Over 50% As Owners Lever Up In The Absence Of Buyers

So what do you do when the bubbly market for your exorbitantly priced New York City commercial real estate collapses by over 50% in two years? Well, you lever up, of course.

As Bloomberg notes this morning, the 'smart money' at U.S. banking institutions are tripping over themselves to throw money at commercial real estate projects all while 'dumb money' buyers have completely dried up.