Horseman Capital Asks "Is China Running Out Of Money"

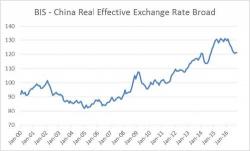

At the start of 2016, many financial pundits mocked Kyle Bass and a handful of other China skeptics for predicting that China's economic difficulties, and accelerating capital outflows, would translate into a continued devaluation for the Yuan. Less than a year later, with the Yuan plunging to all time lows, just shy of USDCNH 7.00, they were right.