What's Next For President Macron

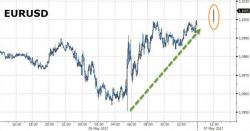

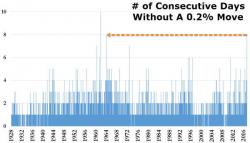

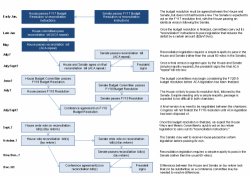

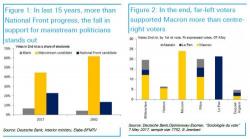

As noted earlier, following Macron's victory the reaction in key FX crosses and pairs has been very subdued, suggesting today's outcome was no surprise to traders at least in terms of technical positioning. Another reason why "the news may be getting sold" is that as Deutsche Bank and various other sellsiders suggested, another near-term hurdle looms in just a few weeks time with the French parliamentary elections.