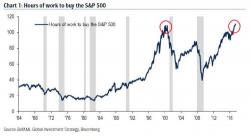

Bank of America: "The Most Dangerous Moment For Markets Will Come In 3 Or 4 Months"

Two weeks after BofA's Michael Hartnett previewed (and timed) not only the "Great Fall" of stocks, but also explained that the Fed and global central banks are now in the business of making the "rich poorer", he is out with a new note which looks at the Fed's latest U-turn, which has unleashed the latest market buying spree, warning that "further upside in risk assets will create problems later in the year" (for three reasons he lists out), and concludes that "ultimately, we believe the extremely strong performance by equities and bonds in H1 is very unlikely to be repeated