Valuations: It Is Different This Time

Authored by Jeffrey Snider via Alhambra Investments,

Authored by Jeffrey Snider via Alhambra Investments,

When it come to performance so far this year, would one be better off owning the S&P 500 or Long-Term Zero coupon bonds? Below compares the S&P 500 to Pimco’s Zero Coupon Bond ETF (ZROZ). So far this year, both have done well and pretty much have the same returns!

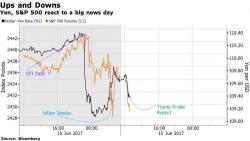

Is it going to be another May 17, when US stocks tumbled as concerns of a Trump impeachment over obstruction of justice and impeachment surged ahead of Comey's tetimony?

Overnight, S&P500 futures accelerated their decline following yesterday's WaPo report that Special Counsel Mueller has launched a probe into potential obstruction of justice by Trump...

With last Friday's "tech wreck" now a distant memory, this morning the "FOMC Drift" described yesterday, which "guarantees" higher stock prices and a lower dollar heading into the Fed announcement is in full effect, with European and Asian stocks rising for a second day, led by rebounding tech shares, while S&P futures are modestly in the green and stocks on Wall Streets hit a record high overnight.

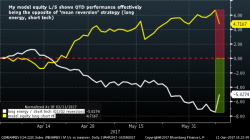

It has been a while since we heard from JPM's quant guru, Marko Kolanovic, who following the recent FANG crash and quant rotations and ahead of this Friday's massive S&P op-ex, has published his latest latter, covering everything from the aforementioned market moves, to the ongoing drastic changes in the market structure, to the prevailing low levels of volatility despite the sharp market selloff on May 17 (with no follow through), and finally concludes with his latest near-term market outlook.