Stocks Surge For 7th Straight Day As US Macro Data Hits 15-Month Lows

"Smells Like Victory" - Happy Memorial Weekend...

Let's start with this...

S&P at record highs as US macro data topples to 15-month lows...

"Smells Like Victory" - Happy Memorial Weekend...

Let's start with this...

S&P at record highs as US macro data topples to 15-month lows...

For weeks I’ve been noting that stocks are being driven by a market rig.

By way of review, that rig is as follows:

1) Someone slams the VIX lower.

2) This forces risk-parity funds to buy stocks, usually the FANGs or large-cap Tech names (Facebook, Apple, Netflix, Google).

3) FANGs rally, which due to the weighting in the S&P 500, forces the overall market higher.

The last point is key.

Authored by Stephen McBride via MauldinEconomics.com,

“I’m telling you right now, the US is going to have a crash and it will be massive,” asserted Mark Yusko at Mauldin Economics’ Strategic Investment Conference.

In his keynote speech, Mark Yusko, CIO of Morgan Creek Capital Management, outlined where he sees the biggest opportunities and risks for investors are today.

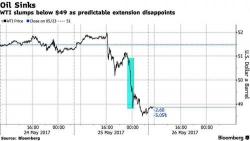

S&P futures were fractionally lower from yesterday's record high as European stocks declined and Asian stocks were mixed, pressured by yesterday's 5% plunge in crude after OPEC unexpectedly "failed to surprise" markets, and announced the bare minimum supply cut extension that was expected by oil traders, who in turn puked long positions.

Authored by Lance Roberts via realInvestmentAdvice.com,

Over the last 30-years, I have endeavored to learn from my own mistakes and, trust me, I have paid plenty of “stupid-tax” along the way. However, it is only from making mistakes, that we learn how to become a better investor, advisor or portfolio manager.