Stocks Jump As Dollar Dumps And Bitcoin Explodes To Record Highs

Just because it made us laugh...

Just because it made us laugh...

That SocGen's Andrew Lapthorne has long held a cynical view of the stock market's relentless grind higher, similar to that of his colleague Albert Edwards, is not a secret: he made as much clear in the first sentence of his latest note to client "time to sell equities to buy bonds?" in which he said that "to the apparent surprise of many, last week the S&P 500 actually fell, losing 1.82% on Wednesday alone, the worst daily return since September last year.

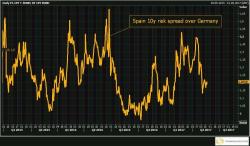

Global stocks were mixed to start the week, with Asian stocks higher, European stocks initially advancing then fading gains, while S&P futures are little changed after the biggest weekly drop since April (which for those keeping record was -0.4%). European shares, the euro and the pound all stumbled on Monday as rumblings in Spain, Britain and Brussels reminded investors that the region still has plenty of political uncertainty left in the tank.

From the latest Weekend Notes by One River Asset Management's Eric Peters

Beep Beep

The market finally woke up,” said Roadrunner, the market’s top volatility trader.“The volatility of the VIX index jumped 40% on Wednesday, that’s the 2nd biggest daily move in the VVIX we’ve ever seen.” The S&P fell just 1.8% on Trump/Comey jitters.

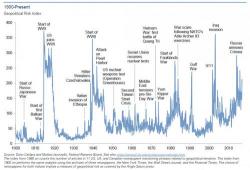

"Gamma", "vega", CTAs, risk-parity, vol-neutral, central bank vol-suppression, the soaring popularity of (inverse) VIX ETFs , and so on: over the past year there have been countless attempts to explain why despite the surging political uncertainty in recent years, and especially since the US election...

... global equity volatility, both implied and realized, has tumbled to record lows, sliding even below levels not even seen before the 2008 financial crisis.

There may be a much simpler reason.