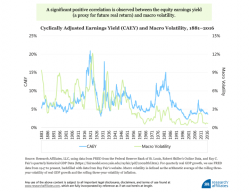

The CAEY Ratio & Forward Returns

Authored by Lance Roberts via RealInvestmentAdvice.com,

Authored by Lance Roberts via RealInvestmentAdvice.com,

The markets are talking but few are listening.

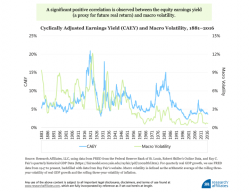

Historically, the start of the second quarter is an EXTREMELY bullish day for stocks. But despite this seasonality the market struggled yesterday. It was only through a dramatic intervention from Central banks that we closed marginally down.

This is a major warning sign.

Indeed, the S&P 500 has broken out of a bearish rising wedge pattern. And even worse, it has FAILED to reclaim critical support. Instead, it has just “kissed” it and then rolled over, which is usually called “the kiss of death.”

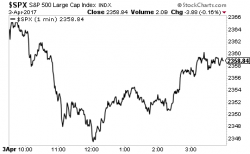

Global stocks were pressured by a poor start to the second quarter in the US, where carmakers reported disappointing sales data, slamming auto stocks around the globe. The selling has persisted for a second day, with Asian stocks and European shares all partially in the red today after their biggest decline in two weeks. Car sector is biggest mover in Europe, offsetting gains in financial services and media.

Authored by Kevin Muir of The MacroTourist

Way back in the 4th quarter of 2015, GMO’s Jeremy Grantham wrote a piece titled “Part II: 2015 and 2016, U.S. Equity Bubble Update, and Yet More on Oil.”

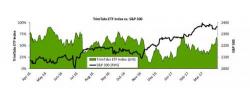

It is easy to forget, but at that point, the S&P was trading around 2,000 and everyone was bearish. QE had ended, the Fed was fumbling with their first hike and “fully valued” were the buzz words used to describe US equities.

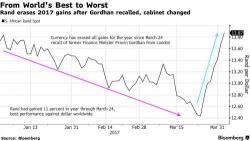

Earlier we showed that when looking at asset returns in the first quarter, there were hardly any underperformers while positive returns were generous across virtuall all asset classes. What drove this outsized performance, which once again left most hedge funds and asset managers seeking to generate alpha in the dust? The answer: a continuation of the capital reallocation euphoria launched with the Trump election in November, which continued for the second consecutive quarter.