Tail-Risk Hedges Spike To Record High

While VIX declined last week, the cost of protecting against major market swings has spiked above its previous Brexit-vote-day peak, reaching a fresh all-time high.

While VIX declined last week, the cost of protecting against major market swings has spiked above its previous Brexit-vote-day peak, reaching a fresh all-time high.

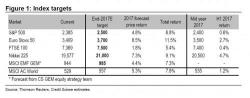

Following bearish reports from Goldman (which tactically downgraded stocks to Neutral for the next three months just hours before the Fed rate hike), RBC and JPM's head quant Marko Kolanovic over the past week, overnight Credit Suisse decided to take the other side of the trade and hiked its year end forecasts for the S&P500, and pretty much every other risk asset, noting that it is happy to "climb the wall of worry", and prefers equities to bonds.

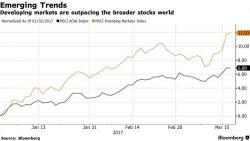

Global markets start the week mixed with Asian stocks rising (Japan was closed for holiday), European stocks sliding, weighed down by declines in oil-and-gas shares and banks, and S&P500 futures also down. The dollar fell to a six-week low, falling four days in a row for the first time since early November as G20 leaders scrap a long-standing commitment to reject all forms of trade protectionism, suggesting the "weak Dollar" camp in Trump's inner circle is winning.

A quiet start to today's quad-witching St. Patrick's day, with European stocks mixed, Asian shares and U.S. index futures (-0.1%) little changed ahead of industrial production data with just Tiffany's set to report earnings.

In 2015, options expirations mattered - stocks would tear higher into the event and like clockwork sink back lower after.

2016 was not so obvious but the all-important 'quad-witch' expirations still had some bias.

However, if JPMorgan's equity derivative strategists are right, tomorrow's 'quad-witch' - with $1.4 trillion worth of S&P 500 notional set to expire - could lead to a vicious cycle higher in volatility going forward.