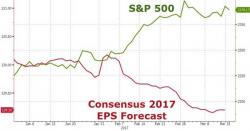

There's One Missing Ingredient From The Market Rally 'Recipe'

Via ConvergEx's Nicholas Colas,

It’s great when a plan comes together.

The recipe for not just today’s rally but the whole move since Election Day is easy. Take one part new Administration with expansive plans to boost the US economy. Add in 2 measures of a Federal Reserve confident enough in existing macro growth to boost interest rates. Add a dollop of money flows.