Unleashing Wall Street

Authored by Bonner & Partners' Bill Bonner, annotated by Acting-Man's Pater Tenebrarum,

To Unleash or Not to Unleash, That is the Question…

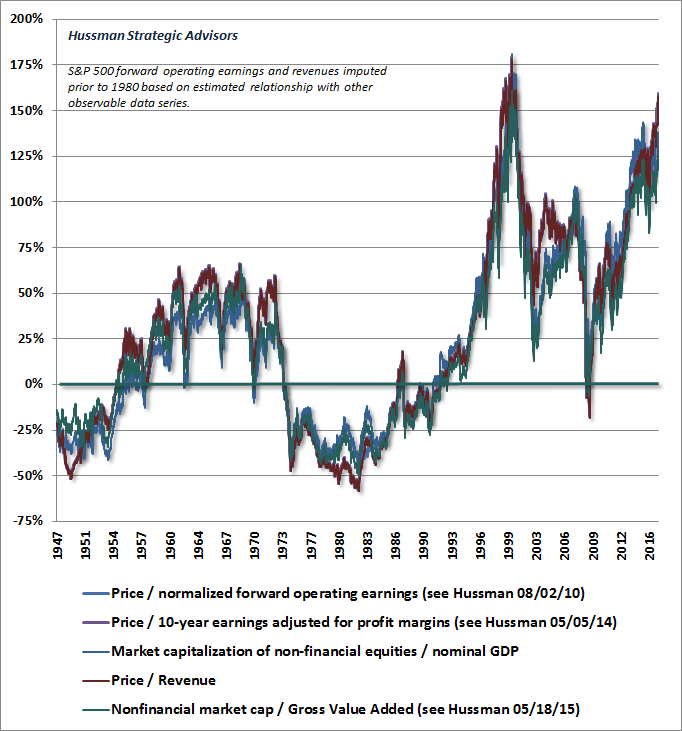

LOVINGSTON, VIRGINIA – Corporate earnings have been going down for nearly three years. They are now about 10% below the level set in the late summer of 2014. Why should stocks be so expensive?

Example of something that one should better not unleash. The probability that a win-lose proposition will develop upon meeting it seems high. It wins, because it gets to eat…