Nasdaq Now More Overbought Than At 2000 Bubble Peak

Sometimes you just have to laugh...

Minneapolis Fed's Neel Kashkari said earlier...

"we are keeping our eyes open for asset prices to try to look for signs of bubbles” but admitted that it is "very hard to see asset bubbles in advance."

Indeed it must be... if your salary depends on it.

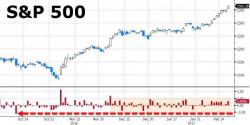

The S&P 500 has now gone a stunning 50 days without a 1% swing...

The S&P 500 Tech Sector has gone a record 14 days without a single loss...