The Dumbest Dumb Money Finally Gets Suckered In

The Dumbest Dumb Money Finally Gets Suckered In

Posted with permission and written by John Rubino, Dollar Collapse

The Dumbest Dumb Money Finally Gets Suckered In

Posted with permission and written by John Rubino, Dollar Collapse

While not quite as damning as its 2018 credit forecast, Morgan Stanley's chief equity strategist Michael Wilson released his 2018 equity outlook this morning, and unlike his last full year forecast which in retrospect was surprisingly accurate, is far more contained, if not outright pessimistic. Wilson himself is quick to remark on just how much conditions have changed over the past 11 months:

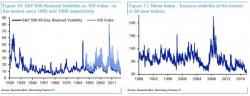

As part of the macro forecast in his just released 2018 Credit Outlook (more on that in a subsequent post), DB's Jim Reid first looks back at the almost concluded 2017 and muses that "whichever way you cut it, it’s likely that 2017 will go down as one of, if not the least, volatile year ever for the vast majority of asset classes. The recent sell-off in early/mid November has been a bit of a wake-up call but overall this remains a blip." In fact, it makes him wonder if 2017 was "the most boring year ever?"

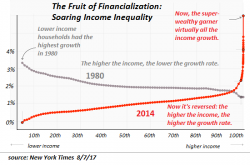

Authored by Charles Hugh Smith via OfTwoMinds blog,

The top 5% who have benefited so immensely from the consolidation of wealth and power cannot confess the status quo has failed the bottom 95%.

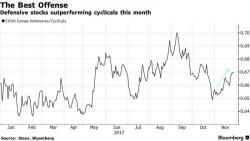

The traditionally illiquid post-Thanksgiving week has started with a series of whipsaws across stocks and bonds, as European stocks turned positive after starting the day on the back foot, initially mirroring a slide in Chinese stocks and price action in U.S. equity futures as investors look to a possible - and absolutely critical - tax-plan vote in the Senate this week.