Fake Market Narratives Are Masking The Roots Of The Next Crisis

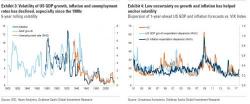

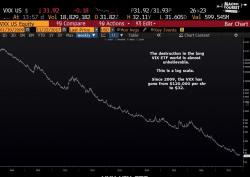

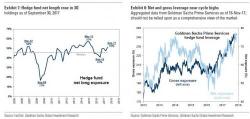

During the second half of an interview with MacroVoices host Erik Townsend, Fasanara Capital fund manager Francesco Filia explained how the trillions of dollars in post-crisis asset purchases by central banks have bred a dangerous trend-following mentality that ultimately undermines the stability of markets and leaves stocks and bonds vulnerable to a vicious reversal.