As The Markets Begin To Crack, Investors Need To See These Two Charts

By the SRSrocco Report,

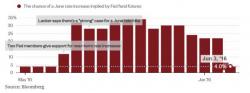

A SERIOUS CRACK appeared in the markets today. This was due to the lousy payroll report of only 38,000 new jobs for May. The market expected 160,000 new jobs, but it turned out to be more than four times less. This is the worst jobs report since 2010.