One Year Later...

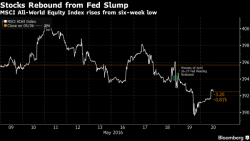

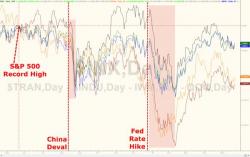

It has now been one year since The S&P 500 reached record highs - proclaimed by all as proof that the recovery was real and that 2008 was dim and dismal thing of the past that could never happen again...

Small Caps (-11.65%) and Trannies (-10.25%) are the worst performers since the S&P peaked on May 21st 2015 closing at an all-time high of 2130.82

Energy stocks are the biggest laggard while utilities lead over the past year...