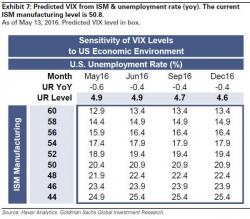

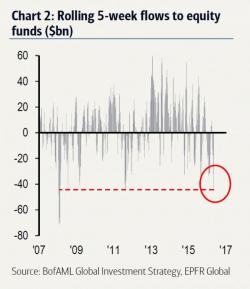

Is VIX Too Low Based On Fundamentals?

In a word... "yes," VIX is too low based on the fundamentals underlying the economy, according to Goldman Sachs.

In a word... "yes," VIX is too low based on the fundamentals underlying the economy, according to Goldman Sachs.

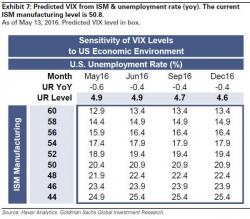

In recent days we have witnessed a massive outflow from virtually all holders of stocks. Just last week we reported that retail had just dumped the most stocks in the past 5 weeks since the August 2011 US downgrade...

... confirming a long-running trend observed with BofA smart money clients who, as we also reported last week, have sold stocks for 15 of the past 15 weeks, the longest selling stretch on record.

This has repeatedly prompted many to wonder who is buying.

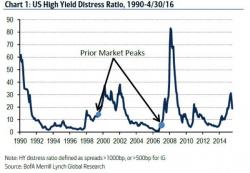

Over the weekend, we were surprised to read that none other than recent market cheerleader Goldman Sachs had come up with six reasons why its chief equity strategist believes the market is poised for a material draw down (read "big drop") in the coming weeks. Among these were the following:

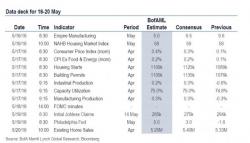

After last week's key event, the retail sales number, which the market discounted as being too unrealistic (and overly seasonally adjusted) after printing at a 13 month high and attempting to refute the reality observed by countless retailers, this week has a quiet start today with no data of note due out of Europe and just Empire manufacturing (which moments ago missed badly) and the NAHB housing market index of note in the US session this morning.

The main risk over the weekend was that markets, which have now dropped for three consecutive weeks the longest negative streak since January, would focus their attention on the latest batch of negative Chinese economic news released over the weekend, which missed expectations across the board, most prominently in Retail Sales (10.1% vs. Exp. 10.6%, down from 10.5%) and Industrial Production (6.0% vs. Exp. 6.5% down from 6.8%), and following Friday's disappointing new credit loan data, would sell off as the Chinese slowdown once again becomes a dominant concern.