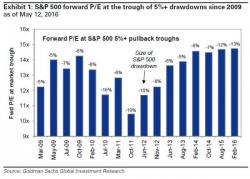

Goldman: The Median Stock Has Never Been More Overvalued

When Goldman warned on Friday that a "big drop" in the market is possible before the S&P hits the firm's year end price target of 2,100, one of the bearish reasons brought up by the firm's chief strategist David Kostin is that stocks are now massively overvalued. In fact, according to Goldman , while the aggregate market is more overvalued than 86% of all recorded instances, the median stocks has never been more overvalued, i.e., is in the 100% valuation percentile, according to some key metrics such as Price-to-Earnings growth and EV/sales.