Institutionalized Lying - Why Central Bankers Never See Bubbles

Submitted by David Stockman via Contra Corner blog,

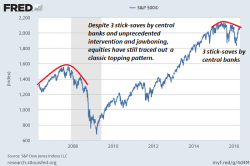

Every day there is more confirmation that the casino is an exceedingly dangerous place and that exposure to the stock, bond and related markets is to be avoided at all hazards. In essence the whole shebang is based on institutionalized lying, meaning that prouncements of central bankers, Wall Street brokers and big company executives are a tissue of misdirection, obfuscation and outright deceit.