"When", Not "If"

Authored by Lance Roberts via RealInvestmentAdvice.com,

Authored by Lance Roberts via RealInvestmentAdvice.com,

World stocks stayed near peaks and currencies moved in tight ranges on Wednesday as China’s 19th Communist Party Congress opened while focus in Europe turned to speeches from top euro zone central bankers before next week’s key policy meeting, as well as Catalonia's ultimatum due on Thursday. S&P futures are solidly in the green as usual, with Dow futures jumping above 23,000, driven higher by IBM as investors looked for new reasons to extend gains after hitting new all-time highs Tuesday.

Hungarian-born billionaire investor George Soros is pledging $18 billion - the bulk of his $26 billion fortune – to his Open Society Foundation, completing the integration of his family office, Soros Fund Management, and the charitable organization that serves as a front for Soros’s globalist agenda.

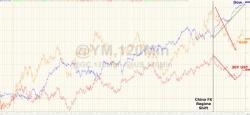

The Dow is now up 17% YTD - crushing bonds and bullion - NOTE everything changed when China’s central bank decided that it would remove a reserve requirement for financial institutions trading in FX forwards for clients by cutting it to zero from 20% currently..

But let's not spoil the party!

For months, we were wondering how much longer Goldman would ignore the relentless market meltup without revising its year-end S&P500 price target, which at 2,400 was not only among the lowest on Wall Street, but also some 150 points away from twhere the S&P currently is. Furthermore, as of this weekend, Goldman's 2018 and 2019 targets for the US equity index, were 2,500 and 2,600, implying there was only 50 points of upside for the next 26 months.