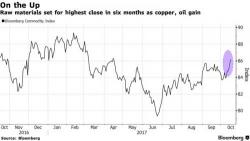

Global Stocks Rise Oblivious Of Growing Geopol Risks; Oil, Commodities Jump On Kurdish Clashes

World stocks and commodities rose on Monday, boosted by upbeat Chinese data, while U.S. oil futures jumped to a near six-month high as escalating tensions between the Iraqi government and Kurdish forces threatened supply. Global markets digested the large amount of weekend newsflow, and clearly liked what they saw as S&P futures were modestly in the green, as both European and Asian stocks are higher.