This Time Isn't Different & The Lack Of Value

Authored by Vitality Katsenelson via RealInvestmentAdvice.com,

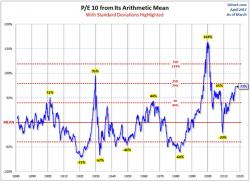

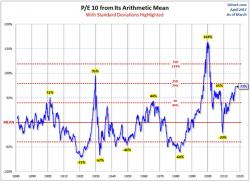

We are having a hard time finding high-quality companies at attractive valuations.

Authored by Vitality Katsenelson via RealInvestmentAdvice.com,

We are having a hard time finding high-quality companies at attractive valuations.

Authored by Alberto Gallo via Bloomberg.com,

A number of markets show not only elevated valuations, but also irrational investor behavior...

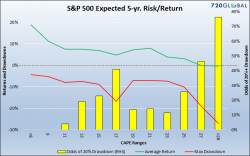

Investors face a conundrum: The world is experiencing a record synchronous growth phase, but an increasing number of assets are becoming overvalued just as fundamental risks lurk in the background. Should investors continue to dance to the tune of central bank stimulus and low volatility, or prepare to exit?

By Kevin Muir via The Macro Tourist blog,

Think back six months. Do you remember all the warnings from the legendary hedge fund managers about the impending stock market doom?

Global markets came off record highs, trading subdued, with US index futures unchanged as traders are unwilling to make major moves ahead of today's ECB minutes and tomorrow’s NFP release, and before speeches by central bankers including SF Fed President John Williams and the potential next Fed chair Jerome Powell, as well as ECB executive board members Peter Praet and Benoit Coeure.

Authord by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Protecting your Blind Side

“The price of protecting quarterbacks was driven by the same forces that drove the price of other kinds of insurance: it rose with the value of the asset insured, with the risk posed to that asset.” -Michael Lewis, The Blind Side