Bitcoin, Sour Grapes, And The Institutional Herd

Authored by Charles Hugh Smith via OfTwoMinds blog,

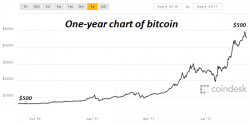

The point is institutional ownership of bitcoin is in the very early stages.

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I'd be a billionaire.

There are three problems with opining that bitcoin and cryptocurrencies are bubblicious: