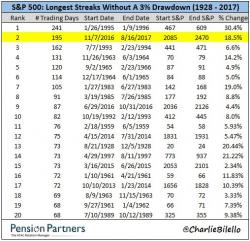

The S&P 500 Is Now Overvalued On 18 Of 20 Valuation Metrics

After last week's brief war with North Korean-inspired volatility explosion (and just as rapid subsequent retracement), some have asked if the resulting market decline, which is down a further 1% on today's latest terrorist attack in Spain, has made stocks more attractive.