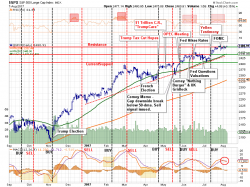

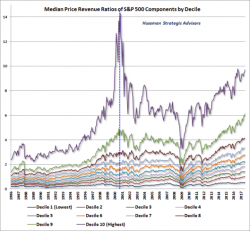

Bull Hopes, Bear Signals

Authored by Lance Roberts via RealInvestmentAdvice.com,

Over the last week, I was on vacation with my family taking a much-needed respite from the weekly workload.

Authored by Lance Roberts via RealInvestmentAdvice.com,

Over the last week, I was on vacation with my family taking a much-needed respite from the weekly workload.

DoubleLine Capital’s Jeff Gundlach has become one of the most visible critics of market complacency, revealing his purchase buy five- and eight-month S&P 500 put options. Now, the legendary bond investor is touting his bet on a spike in equity market volatility as one of his “highest conviction” trades, according to an interview with Bloomberg.

"Volatility is about to go up," he said. "That’s my highest-conviction trade right now."

Authored by Mike Shedlock via MishTalk.com,

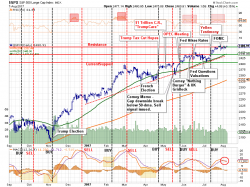

John Hussman’s report this week, Estimating Market Losses at a Speculative Extreme, has an interesting chart on Median price-to revenue ratios over time. Let’s dive in.

I added the dashed blue line for ease in comparison to the dot-com bubble peak. Here are some snips from Hussman.

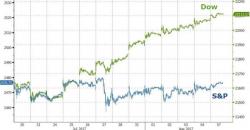

The 9th record close in a row for The Dow (and 10th straight day higher - longest streak since Feb).

As one veteran trader exclaimed "holy smokes... never saw volume this low" -

This is the lowest aggregate S&P 500 e-mini Futs volume for this day in history since 2001...

This is easy...

While Draghi shook things up in late June, it appears to be Janet Yellen's flip-flop that has sparked the latest regime shift in global capital markets.

Since then, traders' expectations for foreign exchange uncertainty has surged, while the outlook for equity, rate, and oil uncertainty has tumbled.

This has left the market now seeing equities as safer than currencies...

When are equities safer than currencies? As Bloomberg notes - almost never, at least until now.