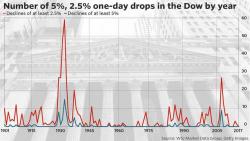

Low Volatility Will Make The Next 5% Drop In The Dow "Feel Like 1987"

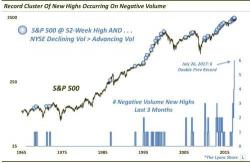

The VIX has recently flirted with its all-time closing low, analysts worry that volatility has been so low for so long that analysts are worried that the next sizable negative shock will cause investors to panic and dump their holdings.