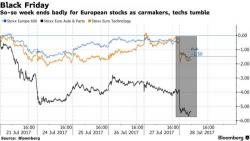

Global Markets, Futures Slide Spooked By Poor Amazon Earnings, US Politics

S&P futures have tracked both European and Asian markets lower, which were dragged down by the big EPS miss and guidance cut reported by Amazon on Thursday. Meanwhile, the pounding of the dollar has resumed with the euro and sterling strengthening against the dollar due to renewed political concerns after this morning's stunning failure by the Senate GOP to pass a "skinny" Obamacare repeal after John McCain sided with democrats.