S&P Futures Bounce As VIX Hammered, Europe "Euphoric"

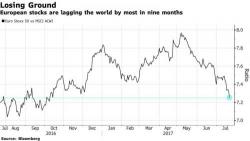

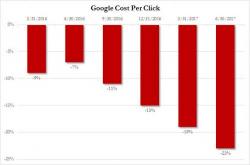

After sliding to 3 month lows on "car cartel" concerns yesterday, European stocks have rebounded after three days of declines, while oil extended gains after Saudi export cuts, with Brent rising above $49 and WTI just shy of $47. Asian stocks fell while S&P futures rose 0.2% to 2,473, putting yesterday's GOOGL drop on plunging Costs-Per-Click in the rearview mirror.