Market "Paralysis" Confirmed - Squeezed Shorts And Anxious Longs Are Fleeing Stocks

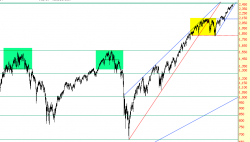

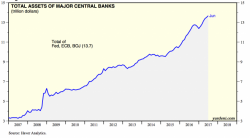

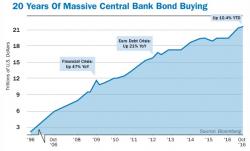

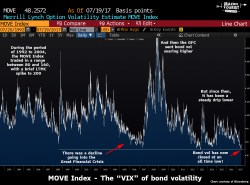

For the last two years, short interest in the US stock market's largest ETF has collapsed as bears have been squeezed back to their lowest level of negativity since Q2 2007 (the prior peak in the S&P). But, there's a bigger issue - despite record highs and 'no brainer' dip-buying, anxious longs have dumped S&P ETF holdings for four straight months - the longest streak since 2009 - seemingly confirming Canaccord's recent finding that "it's not complacency, it's paralysis."