Profit Margins Tumble To Lowest In Four Years... And It's Not Just Oil's Fault

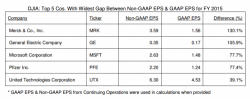

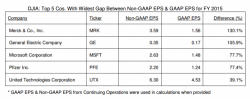

One week ago, we were surprised to see that none other than data aggregator Factset has joined the "crusade" against fabricated non-GAAP numbers. This is what it said:

One week ago, we were surprised to see that none other than data aggregator Factset has joined the "crusade" against fabricated non-GAAP numbers. This is what it said:

Submitted by Ben Hunt via Salient Partner's Epsilon Theory blog,

Five Easy Pieces for the World-As-It-Is

Our story so far...

In addition to today's opex witching, at the close of trading today the S&P will conduct its quarterly index rebalance changes. As Credit Suisse notes, there are no constituent changes during this review, only weight adjustments and according to the bank's adjustments, indexers will need to trade approximately $14.5bn to move to new index weights, of which $13.3 billion will take place in the S&P, accounting for 0.7% of the total two-way turnover.

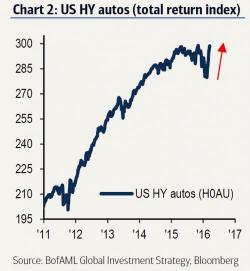

One week ago, despite the ECB's last ditch attempt to reflate the bond market by monetizing corporate bonds in hopes this spills over into stocks (via buybacks) and and broad inflation, Bank of America's Michael Hartnett was adamant: "sell the rally." He wasn't the only one: just a day earlier, after the market's violent kneejerk reaction lower to the ECB's (apparent) unwillingness to push rates even lower, Evercore ISI's chief technician, Rich Ross said "I'm Out. My Bullish tactical call is over."

As CS' Josh Lukeman notes, the degree of hedging we’re seeing as we go higher illustrated in the CS Fear index (now at all-time highs) suggests institutional investors are not believers in the equity rally

CSFB's "Fear" Indicator has never been higher...

For a succinct explanation of what this far less popular indicator captures we use a handy definition by SentimentTrader:

EXPLANATION: