Turmoil In Tech, Trannies, & Tobacco As Dollar Dumps To 2-Year Lows On Dismal Data

Some folks' stocks turmoiled but the message is clear...

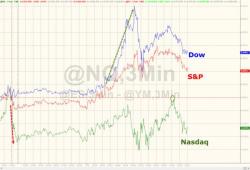

Mixed bag on the week with Trannies tumbling most since Brexit, Dow outperforming on earnings beats, and tech weighing on Nasdaq and S&P...