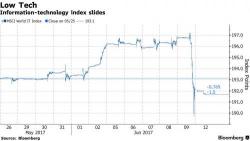

"Tech Wreck" Goes Global Dragging Worldwide Markets Lower; Cable, USDJPY Slide

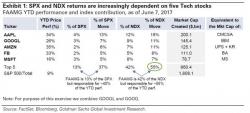

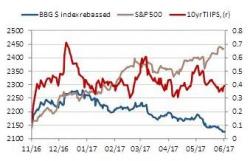

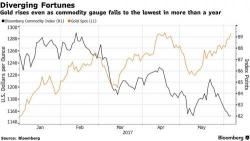

First the bad news: following Friday's "tech wreck" European equity markets have opened lower, with the Stoxx 600 sliding 0.9% and back under the 50DMA for the first time since December, dragged by selloff in tech shares, mirroring Asian markets as Friday’s "FAAMG" volatility in U.S. markets spreads globally, battering shares from South Korea to the Netherlands.