Goldman Explains How Traders Made 4,364% Since 2009 With This 'Simple' Strategy

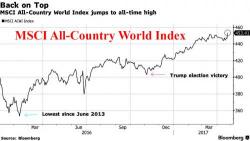

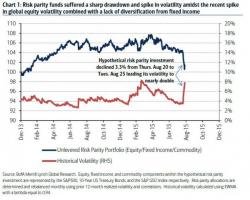

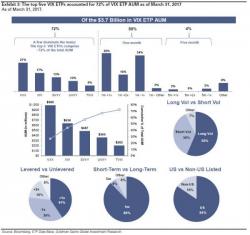

This is too easy. Forget NFLX Calls. As Goldman explains, the road to real riches over the past 8 years (off the '666' lows in the S&P) is simple - Sell Vol!

The S&P 500 VIX Short-Term Futures Daily Inverse Index which tracks the return of being short a one-month VIX future was up 4364% from March 9, 2009 through 1Q 2017.