One Trader Can't Wait For This Week To Be Over

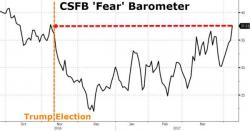

The timing of Bloomberg's Richard Breslow left something to be desired: just hours after he urged traders not to assume that "each event will end badly", the market quickly did just that, breaking virtually every "reflation support line" and then as a cherry on top, Donald Trump flipped on half a year of market narratives, and may have put a final nail in the reflation trade coffin, sending the S&P below the 50DMA for the first time since the election.