"What Has Kept The Rally Going": Some Thoughts From Deutsche Bank

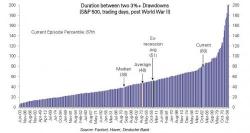

The relentless, steady, monotonous levitation to all time highs keeps chugging along: while last week saw the S&P experience its first 1% intraday move in nearly two months, there has yet to be a comparable move on the downside. As Deutsche Bank notes, pull backs of 3-5% in the S&P 500 are typical every 2 to 3 months historically. The last such pull back occurred just prior to the US presidential election.