Slew Of Negative News, Defaults And Failed Mergers Push Futures In The Green

It has been a busy weekend for mostly negative newsflow.

It has been a busy weekend for mostly negative newsflow.

It is very fitting that on today's April 28th anniversary of the bull market, the day that officially makes this the second-longest "bull market" in history, the market got a stark reminder of just how it got there: through constant and relentless central bank intervention, which has been "beneficial" to stocks for the most part, however last night was anything but.

For those who thought that the world's biggest company losing over $40 billion in market cap in an instant on disappointing Apple earnings, would have been sufficient to put a dent in US equity futures, we have some disappointing news: with just over 7 hours until the FOMC reveals its April statement, futures are practically unchanged, even though the Nasdaq appears set for an early bruising in the aftermath of what is becoming a disturbing quarter for tech companies. "It’s pretty disappointing,” Angus Nicholson, an analyst at IG Ltd., told Bloomberg.

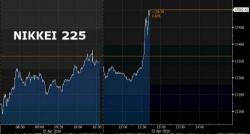

With the Fed decision just one day away, followed the very next day by the increasingly more irrational BOJ, stocks had no desire to make significant moves and overnight's boring session was the result, as European stocks and U.S. index futures rose modestly but mostly hugged the flatline while Asian declined 0.2% for a third day as raw-material shares declined and Tokyo equities slumped before central bank meetings in the U.S. and Japan this week. China’s stocks rose the most in almost two weeks, up 0.6% but failed to rise above 3000 on the Shanghai Composite, in thin trading.

Just as US equity futures were about to roll over following some very substantial misses yesterday by the likes of Google, Microsoft, Starbucks and a plunge in Visa shares, overnight who came to the markets' rescue but the BOJ, when shortly after midnight Bloomberg reported that "according to people familiar with talks at the BOJ" which is the traditional keyword for a BOJ source testing out the market's reaction, Japan's central bank may "help" local banks to lend by offering a negative rate on some loans.