"Bad News Is Great Again" - Global Stocks Soar After Yellen Admits Global Economy Is Much Weaker

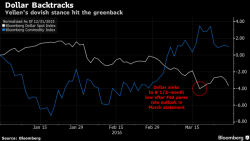

At the end of the day, it was all about the dollar.

At the end of the day, it was all about the dollar.

US Home prices rose 5.75% YoY according to Case-Shiller (the fastest rate since July 2014) as it appears the Chinese buyers are migrating south from Canada with Portland, Seattle, and San Francisco reported the highest year-over-year gains among the 20 cities with another month of double digit annual price increases. Home prices continue to climb at more than twice the rate of inflation amid a suply shortage as West Coast propertty markets become "Vancouvered."

While the prevailing dour (or perhaps sour) overnight mood was a continuation of the weak oil theme which started yesterday after Iran said the production freeze proposed by Saudi and Russia as "ridiculous", and Saudi oil minister Al-Naimi said that Saudi won't cut supply and that high-cost producers need to either "lower costs, borrow cash or liquidate” (ideally the latter), risk sentiment was further dented when BOJ Governor Kuroda says he won’t target FX rates or stocks, which is clearly nonsense, and further spooked Japanese asset prices (Nikkei -0.85), while s

After four months of hope-strewn expectation beats, Case-Shiller's home price index missed expectations with MoM growth slowing from 0.96% to 0.8% (and YoY from 5.83% to 5.74%). This is the first inflection in the resurrection of home-price acceleration since June, and we are sure will be blamed on the weather and the stock market. Perhaps most notably Miami and new York saw prices drop MoM as the smoking gun canaries in the coalmine of real estate speculation remain well worth watching.

Did the cycle just turn again?