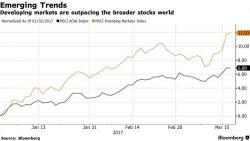

Quiet Start To Quad-Witching St. Paddy's Day: Futures Flat, Global Stocks Mixed

A quiet start to today's quad-witching St. Patrick's day, with European stocks mixed, Asian shares and U.S. index futures (-0.1%) little changed ahead of industrial production data with just Tiffany's set to report earnings.