One Man (Who Is Not A Fan Of Trump) Explains Why Trump Winning Is Good For Democracy

By Mike Krieger of Liberty Blitzkrieg blog,

By Mike Krieger of Liberty Blitzkrieg blog,

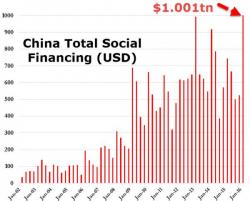

As a result of the dramatic surge in the S&P500 from its February lows, which erased the worst ever start to a year, and nearly regained the all time highs in the US stock market on a combination of a central bank scramble to reflate, the "Shanghai Accord", and the most violent short squeeze in history, coupled with a historic credit injection by China which as we first reported amounted to a record $1 trillion in just the first three months of the year...

... economists have shelved discussions about the threat of a US recession.

That is a mistake.

In an extremely rare occurrence, the U.S. government will not try to squander every single nickel given to it by its taxpayers. As Sputnik News reports, Washington has pulled the funding on a deal that (through the foreign military financing fund) would subsidize roughly $429 million of a $699 million deal to send up to eight F-16s to Pakistan.

Iran has warned that it may close the Strait of Hormuz, through which nearly a third of all oil traded by sea passes, if the United States keeps ‘threatening’ Tehran. On Wednesday, the deputy commander of Iran’s Islamic Revolution Guards Corps said that Tehran may close the Strait of Hormuz to the United States and its allies, if the US continued “threatening” passages through the strategic choke point. The remarks by the acting commander of the Guard also follow those of Supreme Leader Ayatollah Ali Khamenei who criticized U.S.

Speaking through its mouthpiece Global Times, China has published its first reaction to "unpredictable" Trump's position as presumptive Republican nominee and their expectations of a Trump vs Clinton fight for The White House...