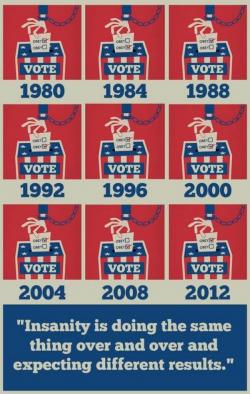

If Voting Mattered, They Wouldn't Let You Do It

Insanity... Just Obey!

h/t The Burning Platform

Know your place..

h/t The Burning Platform

As Doug Casey summarized so eloquently, the political system in the United States has, like all systems which grow old and large, become moribund and corrupt.